YEARLY INDUSTRY REVIEW

Haypp keeps leading transformation in the oral nicotine industry

The number of consumers looking for alternatives for smoking keeps growing every year— and Haypp continues to make an impact to help customers achieve these goals.

The desire for healthier alternatives has risen vs 2020 and led to:

Source: HAYPP LAB Survey 4400 respondents Sweden, Norway, Switzerland, UK, Germany, US

Switching to oral nicotine has saved Haypp Group customers 3,114,042 years of life

Calculation is based on 777,834 consumers with a 53% rate of quitting smoking. The number of years of life gained back depends on when smokers switched to using oral nicotine.

<35 = 10 years 35-44 = 9 years 45-54 = 6 years 55-65 = 4

Source: Haypp Groups Customers 2009-2021; Haypp Lab survey of 4400 respondents in Sweden, Norway, Switzerland, UK, Germany, US; Jha, Prabhat (2020): The hazards of smoking and the benefits of cessation: A critical summation of the epileptological evidence in high-income countries. eLife 2020;9:e49979

Nicotine Pouches is the present and future of oral nicotine

Haypp Lab’s insights help move the industry forward in favour of better choices for consumers.

We use our robust consumer knowledge to understand what drives trends. In the last year we see that the potential of Nicotine Pouches as a category in undeniable.

We are breaking ground in our approach to the nicotine industry.

This report compiles key highlights of our research in 2021 with nicotine pouches as the lead character. This category’s growth is not only based on the increasing interest of consumers in the product, but mainly driven by innovation as the differentiating factor.

Over the past thirteen years, we have built an understanding of what trends are fleeting and which are here to stay. This latest version of the annual report is meant to share visibility and insights with our communities.

The Nicotine Pouch market expands driven by new products

volume from 2020 to 2021

growth in number of brands in 2021 vs 2020

new SKUs from 2020 to 2021

customers from 2020 to 2021

Source: Haypp Group internal data Jan 2020-Dec 2021

Global trends

The global movement to prioritise health and wellness has impacted the nicotine industry, especially after 2020: cigarette purchases are decreasing, and purchases of nicotine pouches are increasing. The category is growing exponentially in some key markets that are leading the change.

Consumers show different behaviours in different markets. With our knowledge around the category we are able to capture crucial data that reflects the main highlights per country.

Haypp Group global trends, by market

Global Attributes Growth

Top 3 biggest product attributes globally

Biggest Flavour:

Mint

Biggest Format:

Slim

Biggest nic. Strength:

Normal

Top 3 fastest growing product attributes globally

Flavour

Fruit

Format

Mini

Nic. Strength

Extra Strong

Source: Haypp Group internal data 2021

Most Successful Innovations

Mini Moist

Launched in late 2020

>1mn cans in 2021

Accounting to 31% of total mini segment

Fruity Flavours

Overtook Citrus and became 2nd biggest flavour after Mint

Synthetic Nicotine

Main format used for new launches in USA in 2021

Key markets are leading the boom in the nicotine pouches category growth

Nordic countries, USA and 3 EU members contributing to a dynamic global market.

Biggest nicotine pouch markets:

Sweden

10.4 million cans

USA

Norway

Germany

Switzerland

UK

Austria

Growth rate

vs 2020:

+0%

Sweden+0%

USA+0%

Norway+0%

Germany+0%

Switzerland–0%

UK+0%

AustriaSource: Haypp Group internal data 2021

Haypp provides a healthy option for consuming nicotine. We have a strong sense of responsibility to our customers and aim to make a positive impact on the industry.

Consumer trends

Haypp delivers information and data focused on consumer’s likes and interests and makes sure we bring their voice right to the manufacturers. Everything we do is grounded into creating better products for our customers. Get to know the nicotine pouches global view and what drives innovation.

Trial Rate

53%

of all Haypp Groups’ purchases in nicotine pouches contained a SKU that those customers bought for the first time. In average, each customer bought 4 new SKUs in 2021.

Source: Haypp Group internal data 2021

Understand how Nicotine Pouches consumers behave

Click a tab to explore more

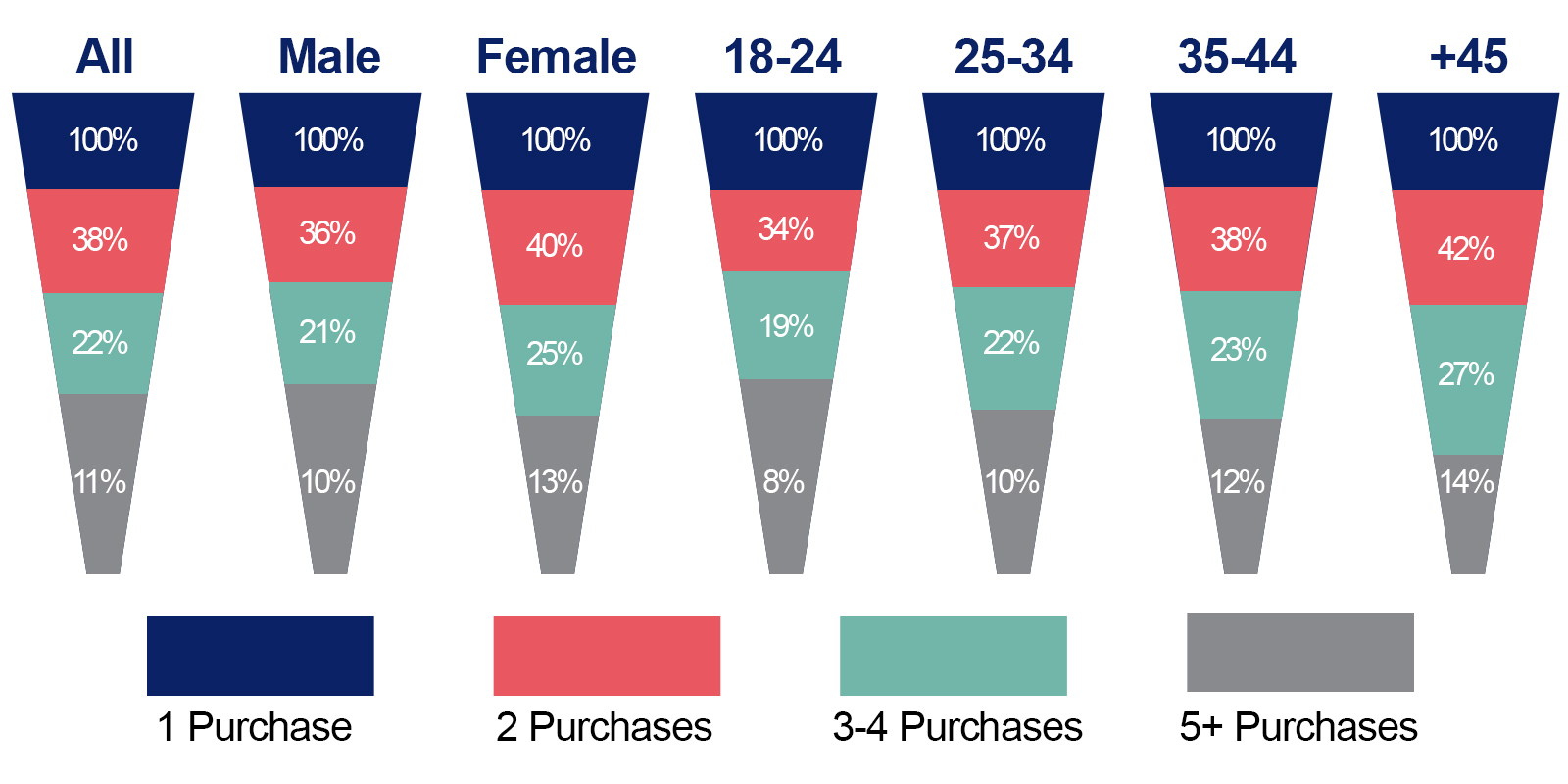

Understand nicotine pouches consumers loyalty funnel by group

The future looks

BRIGHT

Source: HAYPP LAB Survey 4400 respondents Sweden, Norway, Switzerland, UK, Germany, US

Nicotine Pouches category in full motion driven by innovation

The nicotine pouches industry is fast-paced, dynamic and incredibly exciting. This part of the nicotine industry is primed to impact customers by supporting their health and longevity without requiring dramatic behavioural changes. The demand for nicotine pouches continues to increase, as do the opportunities to engage with consumers.

Innovation has played a key role into the expansion of the category, as consumers are constantly looking for new products that fit their needs. We believe the most successful SKU has not been invented yet and we foresee this trend to continue for the upcoming years.

At Haypp Lab, we keep gathering relevant data that will represent the voice of consumers and bring the category forward. We look forward to shedding light on customer behaviour and market trends and using cutting-edge research and analytics to help develop new products and guide brands.

At every turn, we’re ensuring the industry is consumer-centric—and ensuring the future is one consumers are excited about.